Deneme Bonusu Veren Siteler

Deneme bonusu veren siteler konusunda birçok kumar sitesi deneme bonusları sunar. Bu siteler, gerçek bir hesaba kaydolmadan önce denemeniz ve oynamanız için ücretsiz casino oyunları sunar. Mevcut farklı bonus türleri arasında hoşgeldin bonusları, ilk para yatırma bonusları ve para yatırma bonusu yoktur. Bu bonuslar hakkında daha fazla bilgi edinmek için okumaya devam edin.

Online casinoların çalışma şekli birçok insanın kafasını karıştıran bir konudur. Temel olarak, online casinolar bir yazılım kullanarak oyunları rastgele seçilen bir algoritma üzerinden oynatır. Bu algoritma oyun sonuçlarının tamamen rastgele olmasını sağlar ve herhangi bir oyuncunun oyun sonuçlarına müdahale etmesine izin vermez.

Çevrim Şartsız Deneme Bonusu Veren Siteler

Çevrim şartsız deneme bonusu veren siteler hakkında yüzlerce çevrimiçi kumarhane arasında birkaçı öne çıkıyor, yani bets10 ve benzeri. İkincisi, eğer buna bir klan diyebilirseniz, piyasadaki en iyi oyun süitlerinden birine sahiptir ve çok mobil çağda hareket halindeyken oynanabilecek çok sayıda masa oyunu, video poker ve slot ile övünür. Şirket ayrıca, yukarıda belirtilen bir dizi ikramiye ve avantaja, yani yukarıda belirtilen para yatırmadan kaydolma bonusunun yanı sıra yüksek bahis oynayanlar için kendi VIP salonuna sahiptir.

Deneme bonusu veren siteler şunlardır:

- 1xbet

- superbahis

- retrobet

- mobilbahis

- vdcasino

- betebet

- oley

- tempobet

- betonbet

- betpark

Bununla birlikte, meslekten olmayanlar için başlamak için en iyi yer, web sitesinin SSS sayfasıdır ve burada nasıl başlanacağı hakkında bilgi bulunabilir. 888casino, çevrimiçi kumarın zorluklarını ortadan kaldırmayı hedefliyor ve site bir müşteri hizmetleri merkezi bile sunuyor. 888 Casino, dünyanın en saygın oyun şirketlerinden birinin adını ve itibarını taşır ve ülkede oynanabilecek en iyi kumarhanelerden biri olma ününe sahiptir.

Yatırım Şartsız Deneme Bonusu Veren Siteler

Yatırım şartsız deneme bonusu veren siteler para yatırmadan deneme bonusu almak, yeni bir çevrimiçi kumarhaneyi denemenin ve para harcamadan özelliklerini öğrenmenin harika bir yoludur. Ancak, kullanmadan önce herhangi bir bonusun şartlarını ve koşullarını anladığınızdan emin olmak isteyeceksiniz.

Çevrimiçi kumarhaneler, daha fazla oyuncu çekmek için ödül programları kullanır. Bu ödül programlarından bazıları ücretsiz dönüşler ve para içerir. Bonuslar için çevrim şartları da bulunmaktadır. Bunlar, paranızı çekebilmeniz için önce bonus miktarını oynamanızı ve para yatırmanızı gerektirir.

Bazı kumarhaneler ayrıca mevcut oyuncuları için sürekli bonuslar sunar. Bu bonuslar hazır paranızı artırabilir ve sizi aktif tutabilir.

En iyi para yatırma bonusunu bulmanın en iyi yolu, bir çevrimiçi kumarhane bonus veritabanını ziyaret etmektir. Orada en popüler sitelerin bir listesini bulabilirsiniz. Bu web siteleri ayrıca uzman kumar tavsiyesi ve cömert para yatırma bonusu kodları sunar.

Çevrimiçi kumarhanelere nesnel popülerlik sıralaması veren bir web sitesi olan Online Casino City’ye de göz atabilirsiniz. Farklı çevrimiçi kumarhaneleri ve Auslot’ları karşılaştıran inceleme siteleri de vardır.

Deneme Bonusu Veren Siteler 2023

Deneme bonusu veren siteler 2023 konusunda ister blackjack oynuyor ister blöf yapıyor olun, blackjack masasının tepesine doğru yol alın, parmaklarınızın ucunda sizi bekleyen eğlence ve kaçış sıkıntısı yok. Örneğin, size bedava bonus veren kumarhane siteleri olduğunu biliyor musunuz? Açıkçası, bu, kredi kartınıza para yatırmadan siteyi tanımanın harika bir yoludur. Bu sitelerin ayrıca yüz yüze oyun için ofisleri vardır. Bir fincan kahvenizi yudumlarken etkileyici casino oyunları kütüphanesine göz atabilirsiniz. Açıkçası, yeni bir kumarhane arıyorsanız, bu tür siteler gitmek için iyi bir yer.

Deneme bonusu veren siteler şunlardır:

- betgaranti

- grandbetting

- piabet

- aresbet

- betsat

- casinomaxi

- pulibet

- resbet

- restbet

- interbahis

- julibet

- betcup

İlk Üyelik Bonusu Veren Siteler

İlk üyelik bonusu veren siteler, müşterilerine ilk kayıt bonusları sunmaktadır. Bu bonuslar farklı slot oyunları oynamak için kullanılabilir ve bonus miktarı değişebilir. Genellikle, maksimum bahis boyutu, bonus miktarının %5’i veya %10’u kadardır. Bu, oyuncuları oyunu ücretsiz olarak denemeye teşvik etmek için tasarlanmıştır. Oyuncular kazandığında, kazanç ana hesaba aktarılacaktır.

Casino siteleri de müşterilerine mobil uygulama sunmaktadır. Bu, müşterilerin kumarhane sitesine her yerden erişmesini kolaylaştırır. Bu platform, farklı işletim sistemleri ve akıllı telefon modelleri ile uyumludur. Site ayrıca 7/24 müşteri desteği sunmaktadır. Ayrıca, müşteriler özel ödeme yöntemlerini kullanabilirler. Site ayrıca Windows, iOS ve Android dahil olmak üzere farklı işletim sistemleriyle uyumludur.

Hoşgeldin Bonusu Veren Siteler

Hoşgeldin bonusu veren siteler konusunda cömert bir hoşgeldin bonusu veya biraz daha sofistike bir site arıyorsanız, sizin için bir çevrimiçi kumarhane var. Aşağıda en iyi casino sitelerinden birkaçı bulunmaktadır.

Yeni başlayanlar için, şimdiye kadar göreceğiniz en cömert hoş geldin bonusunu sunan yeni bir site var. Şu an itibariyle, 20 farklı para birimi sunuyor. Site ayrıca geniş bir promosyon yelpazesine sahiptir.

Siteyle ilgili bir diğer harika şey de Android, iOS ve Windows cihazlarda kullanılabiliyor olmasıdır. Ayrıca hesaplarınızı gerçek zamanlı olarak takip edebilirsiniz. Hiç para kazanıp kazanmadığınızı görmek bile mümkün. Biraz blackjack oynamak istiyorsanız, bunun için de uygulamaları var.

En iyi çevrimiçi kumarhane siteleri, masa oyunlarından slotlara ve video pokere kadar çok çeşitli oyunlar sunar. Hatta bazı sitelerde gerçek parayla oynanan blackjack oyunları bile vardır. Bu tür şeylerle ilgileniyorsanız, bir Buffalo kumar makinesi bile var.

Bedava Bonus Veren Siteler

Bedava bonus veren siteler seçmek iyi bir fikirdir. Sadece en iyi oyunlardan bazılarını ücretsiz olarak deneme fırsatına sahip olmakla kalmayacak, aynı zamanda tek bir kuruş harcamak zorunda kalmadan site hakkında bir fikir edinebileceksiniz. Ancak, çoğu çevrim içi kumarhanenin, bonus parayı çekebilmeniz için önce depozito gerektirdiğini unutmamak önemlidir. Ayrıca bonusun şartlarını ve koşullarını da okumanız gerekecektir.

Ücretsiz deneme bonusu veren en iyi kumarhane sitelerinden biri, çok çeşitli oyunlar sunan popüler bir çevrimiçi kumarhane olan bets10’dur. Etkileyici oyun yelpazesine ek olarak, bets10 birinci sınıf müşteri hizmetleri sunar ve depozito için ücret alınmaz. Ayrıca, Bitcoin de dahil olmak üzere bir dizi kripto para birimini kabul ederler ve Visa ve MasterCard dahil olmak üzere çok çeşitli kredi kartlarını kabul ederler.

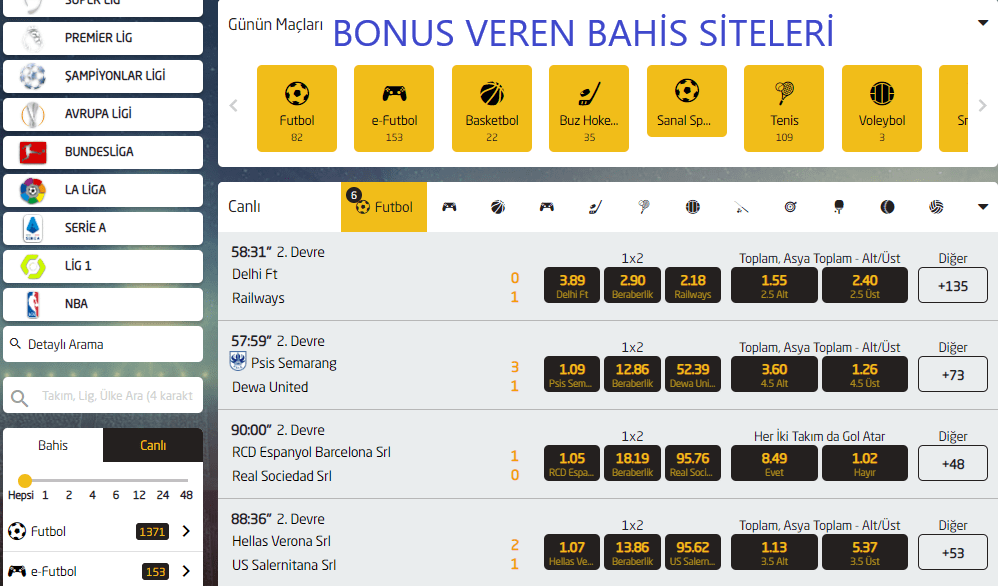

Popüler Deneme Bonusu Veren Siteler 2022

Popüler deneme bonusu veren siteler 2022 konusunda ister en iyi çevrimiçi kumarhaneyi ister en iyi çevrimiçi poker odasını arıyor olun, popüler deneme bonusu 2022’ye sahip çeşitli kumarhane siteleri bulacaksınız. Bu kumarhaneler, masa oyunlarından slotlara ve canlı krupiyeye kadar çok çeşitli kumarhane oyunları sunar. Ayrıca bu sitelerde para yatırmadan bonuslardan yararlanabilir ve eğlenmek için oynayabilirsiniz. Hatta bazı kumarhaneler 100$’a kadar risksiz oyun sunuyor! Bu, siteye çok para yatırmadan önce ayaklarınızı ıslatmanın harika bir yoludur.

Deneme bonusu veren siteler şunlardır:

- oslobet

- mostbet

- slotbar

- tipobet365

- truvabet

- betexper

- klasbahis

- pokerklas

- trendbet

- artemisbet

- bahigo

Aşağıda belirtilen kumarhanelerden bazıları, hoşgeldin bonusunun bir parçası olarak ücretsiz dönüşler sunar. Bu kumarhanelerde ayaklarınızı ıslatmanın en iyi yolu budur. Bu, seçtiğiniz oyunları tek kuruş riske atmadan oynamanın harika bir yoludur. Dilediğiniz kadar bedava dönüş alabilirsiniz. Para yatırma bonusundan yararlanmak için ücretsiz bir kumarhaneye üye olmak için de kaydolabilirsiniz. Bazı siteler ayrıca slot makinelerinde depozito bonusu vermez. Hatta en iyi çevrimiçi kumarhanelerden biri olan jojobet Casino’da para yatırma bonusundan bile yararlanabilirsiniz.

Deneme Bonusu Veren Casino Siteleri

Deneme bonusu veren casino siteleri, kendi paranızı riske atmadan yeni kumarhane sitelerini denemenin harika bir yoludur. Deneme bonusu veren casino siteleri, genellikle size çeşitli oyunları belirli bir süre boyunca oynayabileceğiniz kredisi verir. Ancak, gerçek parayla oynamakla ilgileniyorsanız, deneme süresinin sonunda para yatırmanız gerekecektir.

Bazı casino siteleri de oyuncularına sadakat bonusları sunmaktadır. Bunlar, sabit değerli bir bonus, yüzdelik bir bonus veya eşleşen bir bonus olabilir. Ayrıca, depozitolarda artırılmış maçlar içerebilen indirimli saatler promosyonları sunan kumarhaneler de bulabilirsiniz. Bu promosyonlar aynı zamanda seçilen slotlarda bedava dönüşleri de içerir.

En iyi çevrimiçi bahis siteleri, çeşitli oyunlar ve bahis seçenekleri arayanlar için birçok seçenek sunar. Ayrıca, yeni ve mevcut müşteriler için iyi bir bonus promosyonları yelpazesi sunarlar, bu da paranızı kapıda almanın iyi bir yolu olabilir. Örneğin, bets10, para yatırmadan bonus ve ilk para yatırma işleminizin yüzde onunu netleştirecek ilginç bir karşılama teklifi sunar. Ek olarak, her para yatırma işleminizde size bonus para kazandırabilen bir dizi yeniden yükleme bonusu da mevcuttur.

Yeni Deneme Bonusu Veren Siteler

Yeni deneme bonusu veren siteler konusunda casino sitelerinin çoğu sadakat programları da sunmaktadır. Müşteriler, ödül puanlarını farklı seviyelerde artırabilir ve daha sonra bu puanları bonus için kullanabilirler. Ancak kaydolmadan önce kumarhanenin sadakat programını kontrol etmek önemlidir. Destek ekibi daha fazla bilgi edinmenize yardımcı olacaktır.

Ayrıca para yatırmanıza gerek kalmadan ücretsiz denemeler sunan kumarhane siteleri de bulabilirsiniz. Bu, para yatırmadan önce çevrimiçi kumarhane sitelerini kontrol etme fırsatı verir. Ancak, bir kimlik veya adres kanıtı sağlayarak hesabınızı doğrulamanız gerekecektir. Bu, ehliyetiniz veya elektrik faturalarınız gibi belgeleri tarayarak yapılabilir.

İster deneyimli bir bahisçi olun, ister yeni başlıyor olun, bahis siteleri size ücretsiz bir dönüş vererek fazladan birkaç TL kazanmanıza yardımcı olabilir. Bu, para yatırmasız bir ödül veya ücretsiz para yatırma maçı olabilir. Ancak, bedava çevirme hakkınızı talep etmeden önce, oyunun tüm kurallarının farkında olduğunuzdan emin olun. Ücretsiz döndürmeler yalnızca sınırlı bir süre için geçerlidir ve kazanan bahisler yapmak için kullanılabilir, bu nedenle oyunun kurallarını anlamak önemlidir.